Having recently provided an ETH merge post-mortem, the outcome with regard to the Ethereum-centric mining industry deserves some analysis of its own.

The Ethereum merge took place on September 15 and ultimately it went off without a hitch. So what are Ethereum-based miners sitting on expensive equipment to do now?

Migration to other chains

Pre-merge Ethereum was run on a proof-of-work-based consensus algorithm. Bitcoin too is proof-of-work-based. However, there are different flavors of proof-of-work meaning that Ethereum-based mining rigs can’t be redeployed to mine Bitcoin.

That leaves a range of Ethash-based cryptocurrencies that utilize the same equipment as Ethereum used to, such as Ethereum Classic, Ergo and Ravencoin. A segment of ETH miners believed that the migration of hashrate to these projects would lead to an increase in development and interest in these projects.

Others believed that it would have a detrimental effect on miner profitability relative to such projects. It’s still early but it seems like the latter is playing out.

If there are a lot of individual ETH GPU miners, it would seem intuitive that if they bail in to other projects, then they’re effectively growing those communities. However, adding mining power without any other positive developments related to the blockchain is likely to result in reduced profits as more miners chase the same level of reward. As profitability crumbles, then their interest will crumble with it.

Added to that, there is much less utility with altcoins than with Ethereum. That means that miners are more likely to dump coins onto the market, driving token prices of these alternative mineable blockchains down. If anything, it may only serve to destabilize those projects rather than give them a shot in the arm.

What happened with EthereumPoW?

In the months leading up to the merge, some Ethereum miners decided to fork away from Ethereum and create a blockchain that continued on in the same way as Ethereum existed pre-merge. Spear-headed by developer Chandler Guo, EthereumPoW was created with the accompanying ETHW ticker symbol.

The efforts of the proponents of ETHW have been thwarted thus far. The issue wasn’t getting support from the mining constituency; it was support from other stakeholders in the digital assets space that was lacking. One by one, major players in crypto came out and said that they were fully behind Ethereum’s merge and that they would not be supporting blockchain forks like ETHW.

Guo had been one of the key developers who created the Ethereum Classic fork back in 2016 following the DAO hack. His effort with ETHW meant that the new blockchain wasn’t differentiated much from Ethereum Classic. If anyone favored a proof-of-work-based Ethereum, Ethereum Classic would make for a much more logical choice given that it already exists and has built its own community.

ETHW unit price plummets following a successful ETH merge : IMG SRC

ETHW unit price plummets following a successful ETH merge : IMG SRC

It seemed that ETHWs only hope was if the Ethereum protocol upgrade went badly wrong. Leading up to the merge, the ETHW unit price suffered as announcements came in from major players saying that they would not be supporting the forked blockchain.

When it became clear that the merge had been a success on September 15, the ETHW price plummeted. Despite that, it’s proponents continue in their attempts to drive the project forward. On September 29, global exchange Binance announced that it was launching a ETHW mining pool.

Guo is sticking to his guns and in a recent interview, he claimed that ETHW will grow to rival ETH.

Alternative use cases

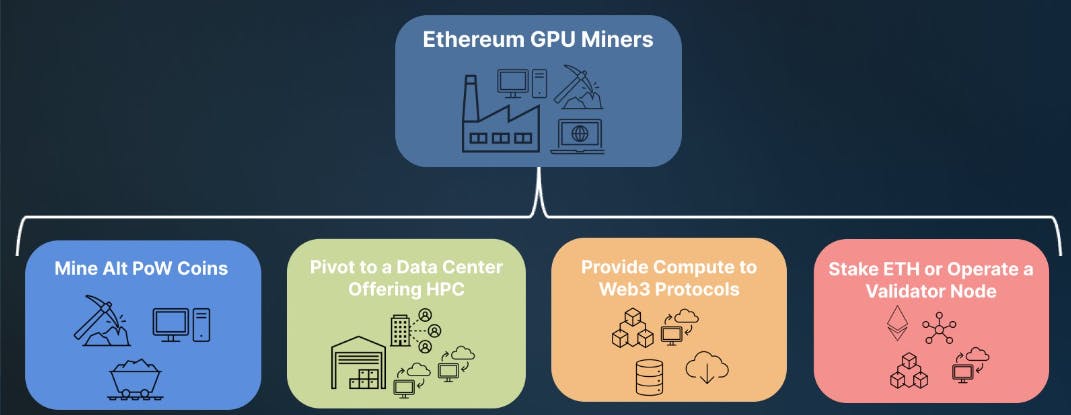

Facing limited or unprofitable alternatives in blockchain mining, some turned their thoughts to repurposing mining equipment for other use cases.

High performance computing (HPC) — the ability to process data and perform complex calculations at high speed — is one such option. CoreWeave is an example of an enterprise that has pivoted from Ethereum mining to become a high performance cloud computing provider.

The firm has been positioning itself to deal with the merge for some time. In 2021, cloud computing accounted for 14% of its revenue and by end of year 2022, the plan is HPC will make up 50% of revenue. CoreWeave has also worked on converting GPU power towards graphics rendering. Naturally post-merge it’s no longer in the ETH mining business.

Ethereum GPU miner repurposing options : IMG SRC

Ethereum GPU miner repurposing options : IMG SRC

Hive Blockchain — which had operated one of the world’s largest single site Ethereum mining farms in the world — had a strategy in place in anticipation of the merge. That plan included switching some facilities to Bitcoin mining and mining alternative proof-of-work blockchains but also repurposing to provide cloud computing, rendering for engineering applications and computing power for AI applications.

Hut8 Mining has partnered with cloud computing specialist Zenlayer to repurpose its capacity to HPC cloud computing. In the scramble for alternatives, some have transitioned to simulating proteins for medical research. This is very much a niche use case that only makes sense for single GPU miners. It doesn’t scale for mining farms.

In its effort to stay relevant, Ethereum’s largest mining pool Ethermine has pivoted to Ethereum staking instead. It paid out the last mining reward to pool members a couple of days following the merge.

While its admirable to see efforts to repurpose this equipment, these use cases are only likely to see a fraction of Ethereum mining kit re-used. A lot of that hardware will go to Taiwan and China where there’s currently demand for GPUs with inadequate supply.

According to Kristy-Leigh Minehan who offers consultancy on digital assets infrastructure and mining, a lot of these GPUs - there’s an estimated 27 — 53 million Ethereum GPU cards — will end up without a use.

An e-waste apocalypse

Anyone that has an interest in energy use and the environmental aspect of that has heralded the merge. The protocol upgrade has been responsible for a 0.2% decrease in global electricity consumption. That’s quite the feat but it ignores the environmental elephant in the room — Ethereum mining e-waste.

ETH mining farm : IMG SRC

ETH mining farm : IMG SRC

We’ve talked about the limited options facing Ethereum miners when it comes to alternative blockchain mining options. We’ve also considered what seems like limited alternative use cases.

The upshot of all of that is that we’re likely to see a mass dumping of mining GPUs on sites like Ebay, Craigslist and Facebook Marketplace. They will be picked up at bargain basement prices by buyers who will soon discover that their attempts to use them for mining purposes will be unprofitable.

Beyond that, they’re going to end up in landfill given that only about 20% of e-waste ends up being recycled. It could be argued that the Ethereum Foundation and the Ethereum core devs should share the blame for this e-waste apocalypse.

All efforts went into achieving the protocol upgrade. There’s little evidence of any effort being put in to research alternative use cases or devise plans to repurpose all of that expensive and resource-intensive mining kit.

Cause and effect

The response by Ethereum miners discussed above is a classic case of cause and effect. Here are some more outcomes that have happened as a direct result of a successful Ethereum merge on September 15.

Part of the reason Ethereum slumped upon completion of the merge is suspected to be due to Ethereum miners dumping ETH onto the market as part of their efforts to wind up their mining activities.

It’s an ill-wind that doesn’t favor someone or other. Gamers have long been embittered by the demand from Ethereum mining for GPUs. That demand either made GPUs unavailable entirely to gamers at times or otherwise, it made PC gaming incredibly expensive for them. As chuffed as Ethereans were with a successful merge, gamers were ecstatic. It means that GPU pricing is likely to fall considerably, making their hobby much more affordable.

Wrapping up

We’re only a few weeks into a post-merge Ethereum. However, it seems like we can expect few other outcomes beyond those we’ve discussed for a once lucrative Ethereum mining business that is now firmly out of business.