Meta, formerly known as Facebook, almost got into the blockchain game. After Mark Zuckerberg abandoned the project, its developers repurposed what was left and created their own blockchain: Aptos.

This article explains what it is, how it works, and why a lot of people are concerned about the way it is structured.

How Aptos came to be

When Meta got into the blockchain game in 2019, it created Libra, a payments project that created a currency pegged to the reserves of several major world currencies.

Libra was very unpopular because Facebook invited a bunch of very large companies, like Uber, Visa and Mastercard into its ranks. They would control the ratios of the reserves that backed up this currency.

Libra wasn’t quite a cryptocurrency and didn’t run on a blockchain – but it was close enough to one that people thought that Facebook was getting into the crypto game.

Central banks from major world governments thought this would be a problem if the thing took off because then just a handful of companies would have a huge amount of influence over the importance of different world currencies.

If the companies wanted to minimize the importance of the dollar, they could freely reduce its waiting within the Libra coin.

This power, claimed central banks, would undermine the value of the levers they can pull to affect the supply and demand of their own fiat currencies, thereby destabilizing the global financial system.

After much consternation from central bankers and finance ministers, several major companies thought it wasn’t worth the trouble, and dropped out of the project.

In an attempt to salvage what remained, the project rebranded to Diem and focused on a U.S. dollar stablecoin. Diem was a proper blockchain - although it was permissioned, meaning that only a select group of people could validate transactions.

Things still didn’t get much better for Diem either, and in January 2022, Facebook, which had just renamed itself to Meta months earlier in the hopes that a big push into the metaverse would once again throw the social media company into relevance, called it quits on the project.

Although the whole idea of reshuffling the global financial order in Meta’s favor was unpopular, several key developers thought that the underlying technology of Diem was robust enough to build on.

It said that the technology – proper blockchain stuff – was fast, capable of 130,000 transactions per second thanks to an engine called Block-STM, and cheap.

And it claimed that it was pretty efficient at processing transactions simultaneously – unlike blockchains that process transactions one by one, like Ethereum, or those that process transactions without much efficiency at all.

If true, that could solve the scalability problem that other blockchains, most prominently Ethereum, have suffered from over the past few years.

So instead of shelving the entire project, the developers kept working on it under a new name – Aptos. Former Meta employees run the show: Mo Shaikh is its CEO and Avery Ching the CTO.

How Aptos Works

Aptos is a Layer 1 blockchain – that means that it’s the fundamental, independent network itself, and isn’t connected to any other blockchains. Bitcoin and Ethereum are other examples of Layer 1 networks.

The blockchain’s native currency, used to pay validators to process transactions, is also called Aptos. This is shortened to APT. The smallest unit into which an APT token can be divided is called an Octa.

Aptos uses a lot of the same things as Diem, such as Move, a Rust-based programming language Meta had developed to power the network. Move is also set to be used by Sui, another blockchain that hasn’t launched yet.

"Move in many ways is inspired by Rust," Ching told CoinDesk. "The difference here is that Move is built for smart contract language development. We found that this would be easier for developers to build compared to languages like Solidity."

Aptos also uses the same technology as Diem to efficiently process transactions simultaneously. To speed things up and prevent a single botched transaction from causing a bottleneck on the network, Aptos validates transactions after processing them.

The network is also open – unlike the relatively closed and Meta-controlled metaverse that Zuckerberg had touted since his company’s rebrand in late 2021. (It should be noted that although it is open, early investors and the team hold the lion’s share of staking tokens, meaning they process most of the transactions – as is discussed in detail later on).

To that effect, Aptos supports decentralized finance (DeFi) projects.

Like Ethereum and Solana – Aptos’s main rivals – Aptos is a proof-of-stake chain. That means that groups of computers, known as validators, earn coins for processing transactions.

On proof-of-stake networks, coins are “staked” – locked up on the Aptos blockchain, and those who stake more coins are proportionately more likely to earn the right to process these transactions and receive new coins.

Meta promised not to enforce its crypto patents against Aptos – paving the way for others to finish the job it had started.

After it cut ties with Meta, Aptos received funding from top venture capital funds. In March 2022, Multicoin Capital, a16z and Tiger Global were among investors that lobbed $200 million at the project.

Four months later, Jump Crypto and FTX Ventures (since defunct after FTX collapsed in November 2022) invested $150 million in the project.

Binance Labs and Dragonfly Capital invested more in a venture round in September 2022. The size remains undisclosed, but according to Bloomberg, the funding brought the valuation of the project to more than $4 billion.

Aptos launched in May 2022. Well, kind of – it pushed out the first phase of an incentivized testnet, which is a test version of the blockchain that lets people play with tradeable cryptocurrency.

Three more phases of the testnet followed before Aptos launched its mainnet – the 1.0 version of the blockchain – in October 2022. That sent its token, which operates under the ticker APT, into the hands of the public.

Aptos’s rocky start

But…the launch of the mainnet didn’t go so well.

Pseudonymous developer ParadigmEngineer420 tweeted that he observed just four transactions per second – nowhere near the limit of 130,000 – and that most of these transactions are “merely validators communicating and setting block checkpoints and writing metadata to the blockchain.”

A month after launch, Aptos’s real-time blockchain explorer shows that it operates at speeds of 12 transactions per second – even slower than Ethereum’s speed of 14 TPS – and peaked at a TPS of just 2,107 since launch.

Investors were also disgruntled about the fairness of Aptos’s token distribution, which wasn't fully disclosed to the public until after the project launched. About 820 million of the 1 billion APT were staked at launch – “This means that a bit over 80% of the token supply is controlled by the team and investors,” said ParadigmEngineer420.

Aptos’s CEO, Mo Shaikh, jabbed back against the complaints. He told CoinDesk that the token distribution was ”among the most fair that we have seen even compared to other projects."

An official statement said that 51% were minuted to community members – and that core developer, Aptos itself and private investors held the rest.

But even this sparked consternation, considering Ethereum gave just 9.9% to the founding team and reserved another 9.9% in an organization to build the network.

The fear was that developers and insiders held too many tokens, and they could dump their bags on regular investors whenever they liked – dashing hopes of a truly decentralized blockchain network.

Aptos pushed back against the criticism, saying that it had taken steps to prevent people from gaming the system to collect extra APT tokens.

Shaikh continued: "There are also pretty strong lockup periods. If someone wants to dig a bit deeper they would realize that investors can't dump on retail, they are totally blocked from doing that.”

The four-year lockup period, for instance, prevents investors and core contributors from using tokens for an entire year.

But that excludes staking rewards – and 82% of tokens were staked at launch, and even locked tokens can be staked. That’s what wrangled the pseudonymous developers.

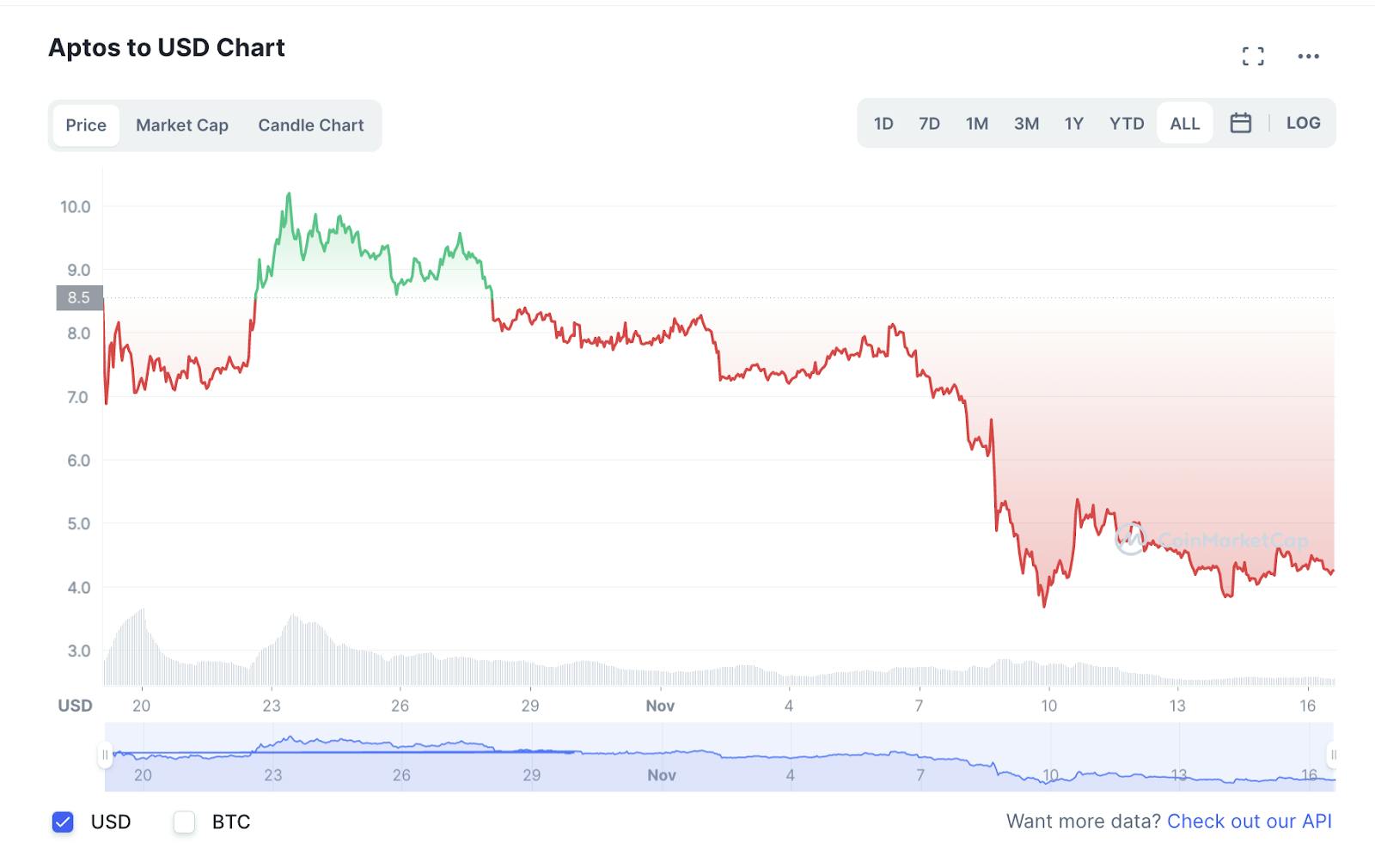

And an airdrop, issued to insiders in October, was only announced at the last minute, sparking chaos in the markets. APT’s token ultimately price fell after launch in October, falling almost 50% from its listing price in the first few hours of trading.

The token’s price rebounded but fell even lower after its major backer, FTX, went bust in November. Lots of investors thought that Aptos would follow the fate of Solana, another Layer 1 coin that FTX had heavily invested in before crashing.

Aptos’s DeFi network isn’t doing much better. A month after launch, investors have locked just $37 million into its smart contracts, several orders of magnitude smaller than Ethereum, or even its upstart rival, Solana.

“Many Solana DeFi projects were launched this way and have suffered a down-only fate,” said Blockworks analyst Dan Smith. “I am wary about Aptos, but in the end state of crypto, I believe there is room for a blockchain that optimizes for throughput.”

According to DeFi Llama, a data analytics site, the largest DeFi protocols on Aptos are decentralized exchanges LiquidSwap, AUX Exchange and PancakeSwap.

One pocket of hope, according to crypto publication Decrypt, is Aptos’s NFT market, which surpassed volumes on both Solana and Ethereum by daily trading volume in late October.

But the NFT market is also dying during the crypto winter. Will Aptos wither away, too?